Stripe

Stripe powers online and in-person payment processing and financial solutions for businesses of all sizes.

Overview

Stripe is a comprehensive payments platform that handles everything from payment processing to financial reporting. This guide will walk you through connecting your Hypermode agent to Stripe, enabling automated payment operations, customer management, and financial data analysis.Prerequisites

Before connecting Stripe to Hypermode, you’ll need:- A Stripe account (individual or business)

- Stripe API credentials (publishable and secret keys)

- A Hypermode workspace

Setting up Stripe

Create your Stripe account

If you haven’t already, sign up for a Stripe account. You can start with a test account to experiment safely.Access your API keys

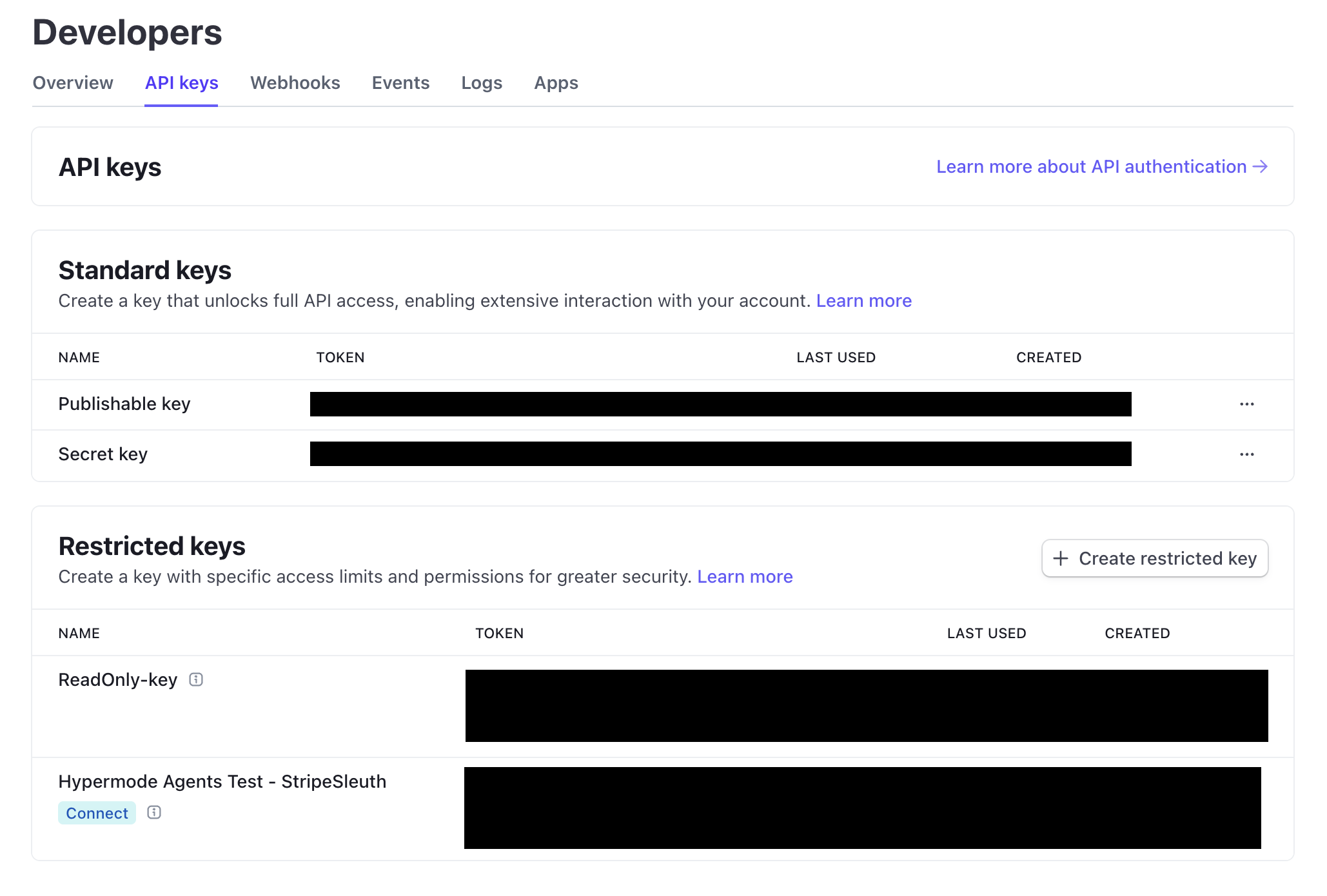

Navigate to your Stripe dashboard to find your API credentials:- Go to Developers → API keys in your Stripe dashboard

- You’ll see both test and live API keys

- Start with test keys for development

Stripe provides separate test and live environments. Always start with test

keys during development to avoid processing real payments accidentally.

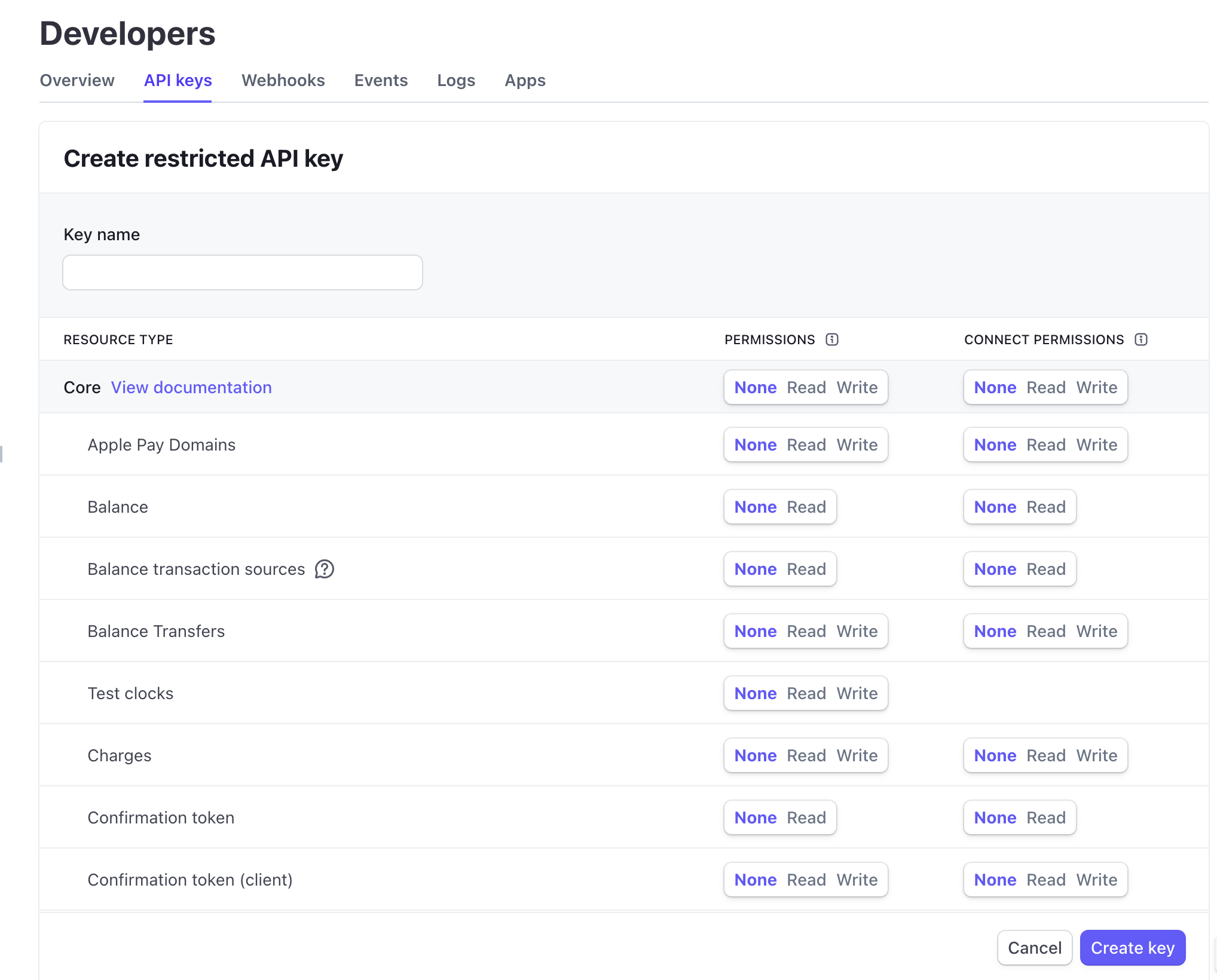

Create a restricted API token (Recommended)

For enhanced security, create a restricted API token with only the permissions your agent needs:- Go to Developers → API keys

- Click Create restricted key

- Select specific permissions based on your use case

- Customers: Read and Write

- Payment Intents: Read and Write

- Charges: Read

- Invoices: Read and Write

- Products: Read and Write

- Subscriptions: Read and Write

Only grant the minimum permissions your agent actually needs. This follows the

principle of least privilege and enhances security.

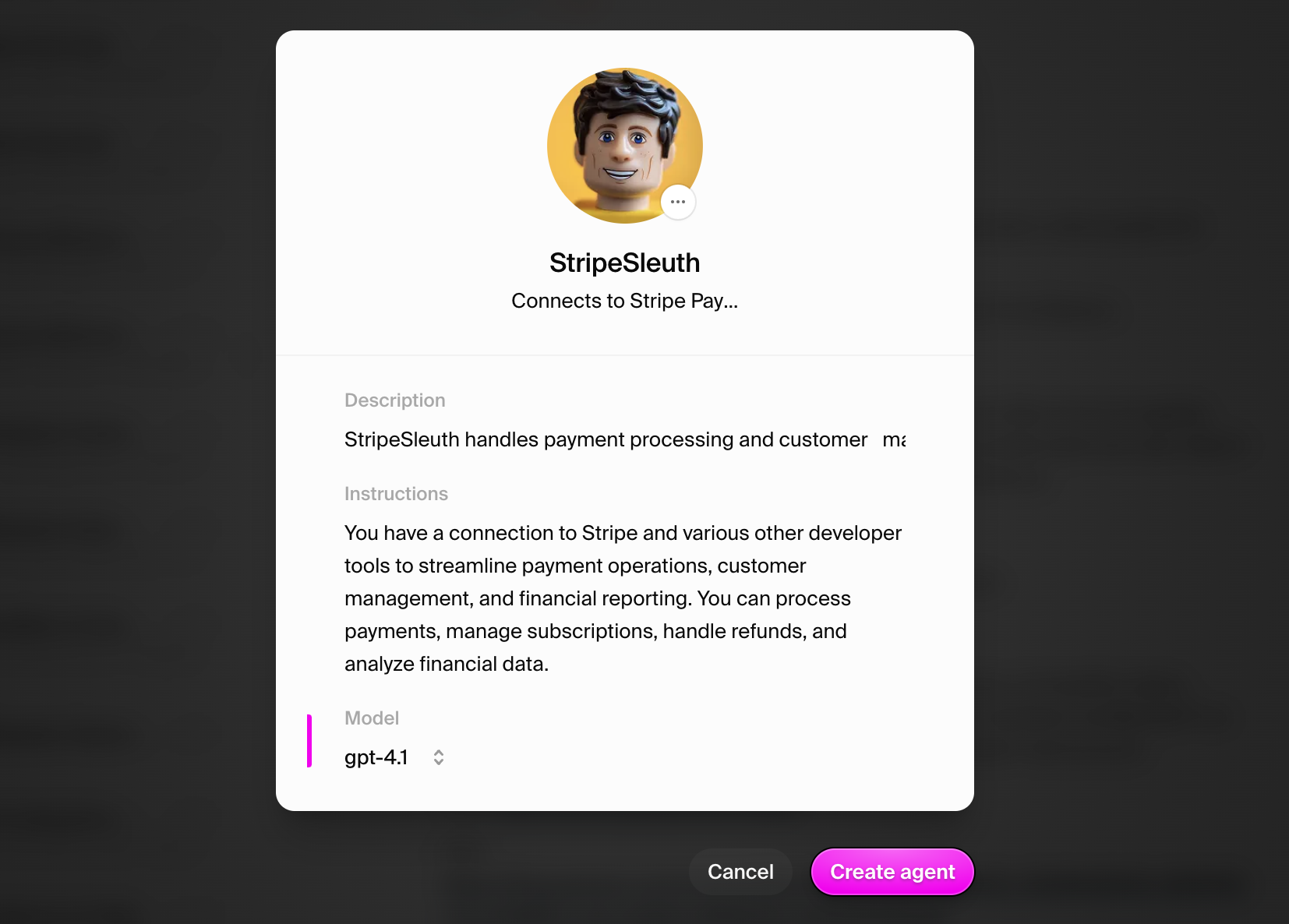

Creating your Stripe agent

Create a new agent

From the Hypermode interface, create a new agent manually:- Click the agent dropdown menu

- Select “Create new Agent”

Configure agent settings

Use these recommended settings for your Stripe agent:- Agent Name: StripeSleuth

- Agent Title: Connects to Stripe Payments

- Description: StripeSleuth handles payment processing and customer management

- Instructions: You have a connection to Stripe and various other developer tools to streamline payment operations, customer management, and financial reporting. You can process payments, manage subscriptions, handle refunds, and analyze financial data.

- Model: GPT-4.1

Connecting to Stripe

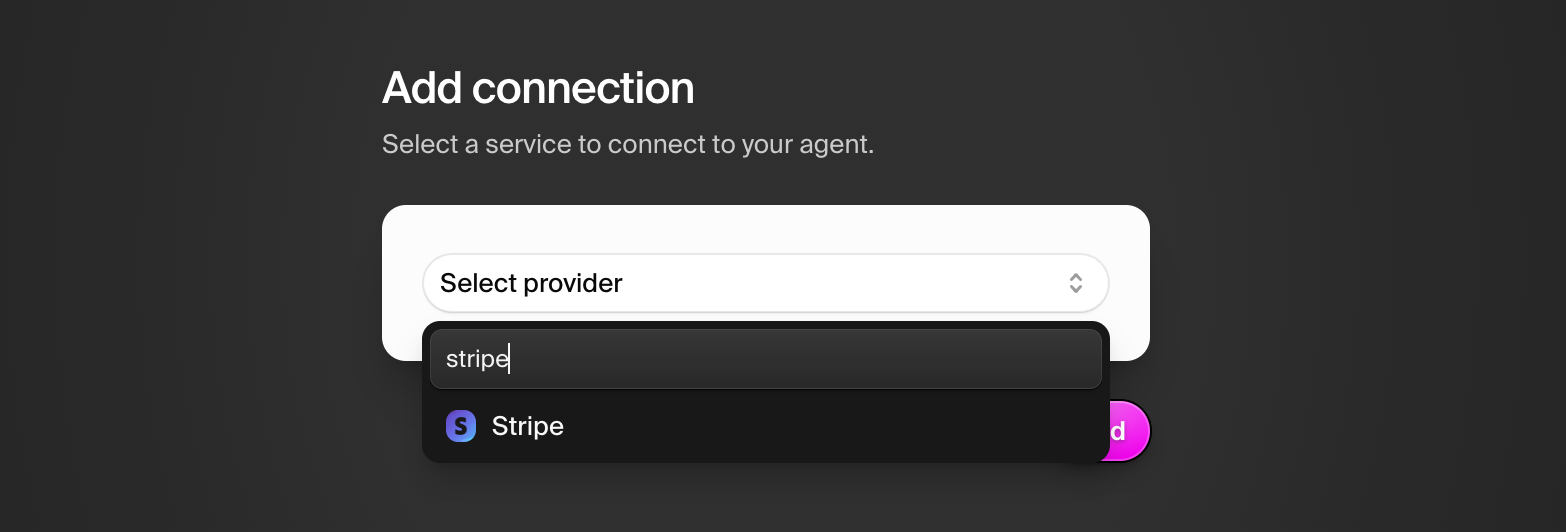

Add the Stripe connection

Select the Agents tab in the left navigation bar, then click your StripeSleuth agent. Select the “Connections” tab.- Click “Add connection”

- Select “Stripe” from the dropdown

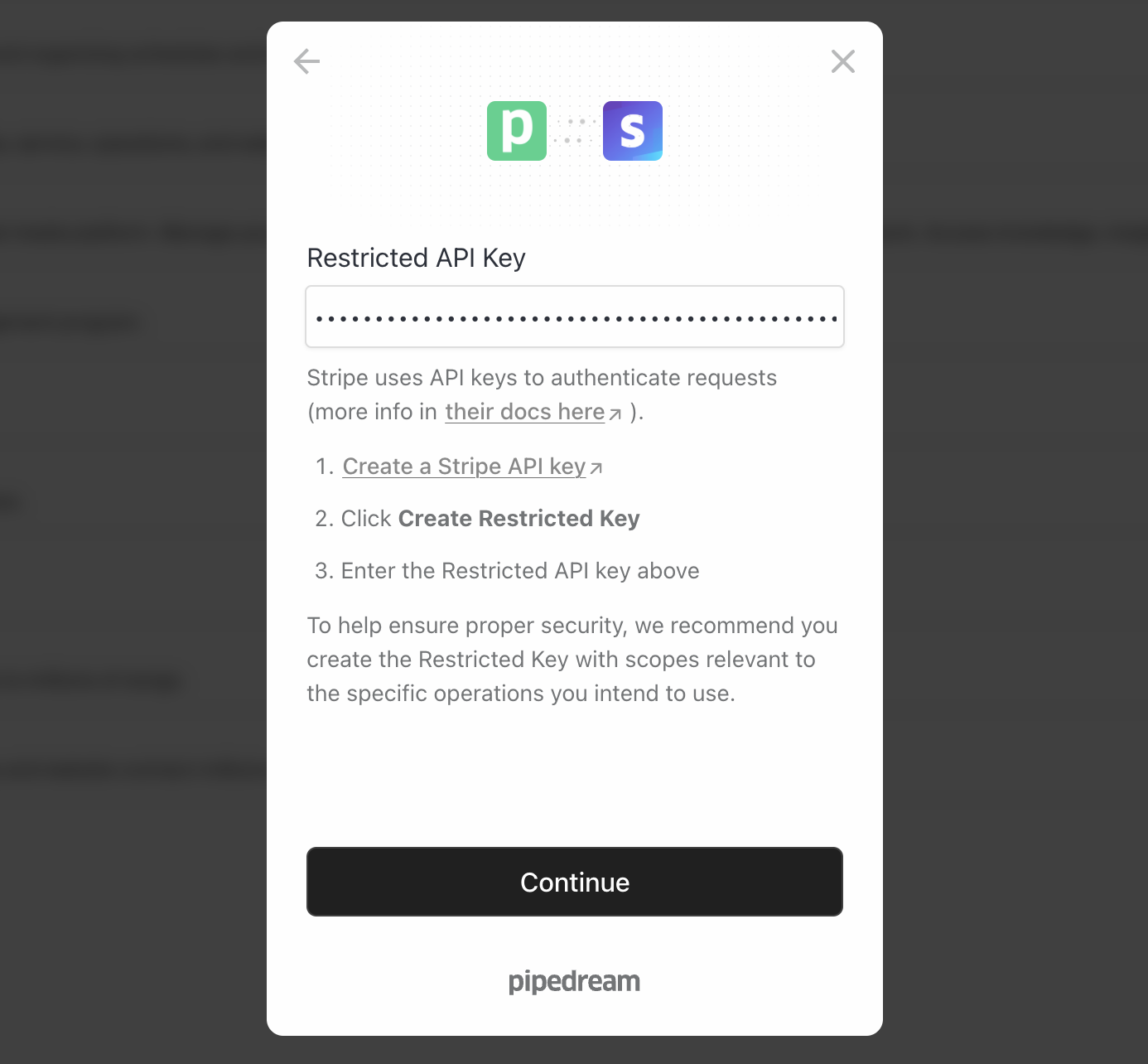

Configure credentials

Enter your Stripe credentials:- API Key: Your Stripe secret key (starts with

sk_test_for test mode orsk_live_for live mode)

Keep your secret API key secure! This key provides full access to your Stripe

account and should never be exposed in client-side code or shared publicly.We recommend using a Stripe Sandbox environment for development and testing.

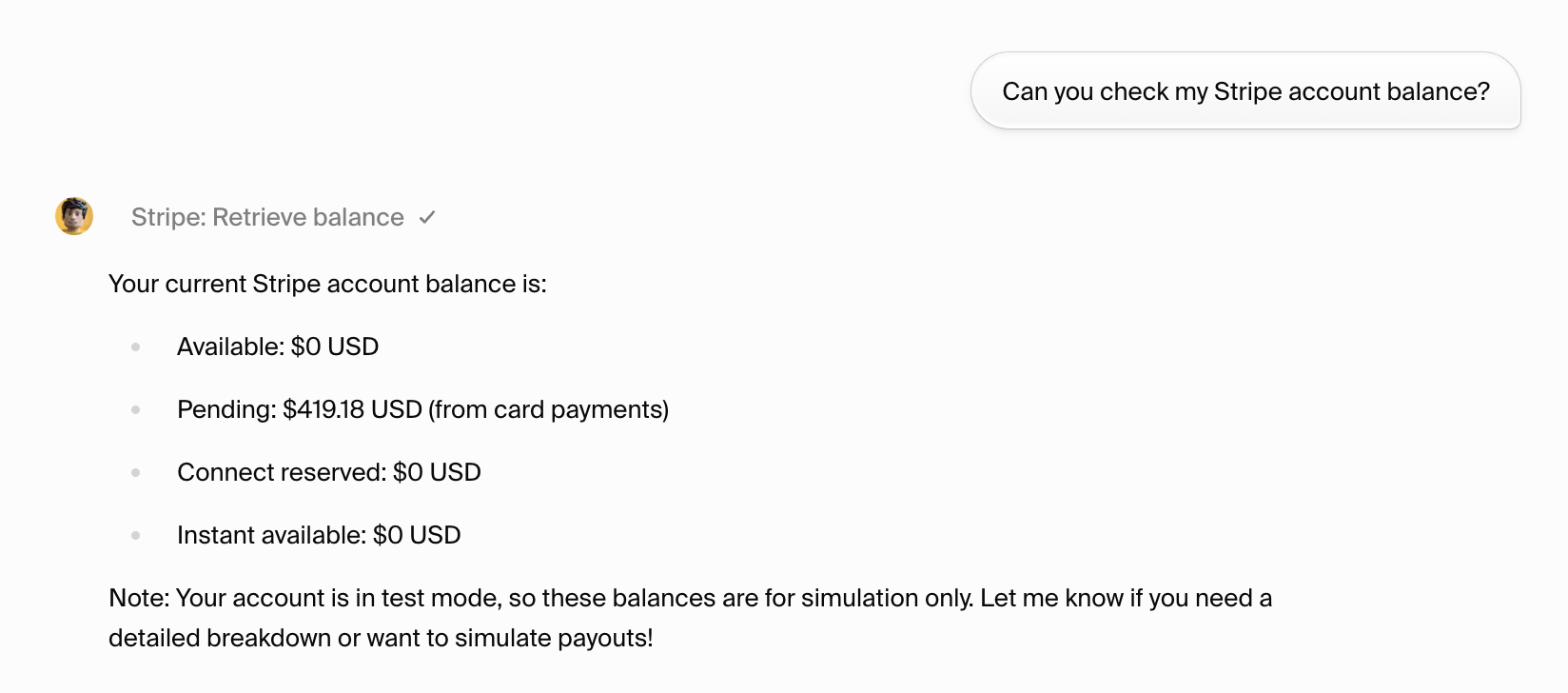

Verifying the Stripe connection

Test basic connectivity

Start a new thread and test the connection with a simple query:

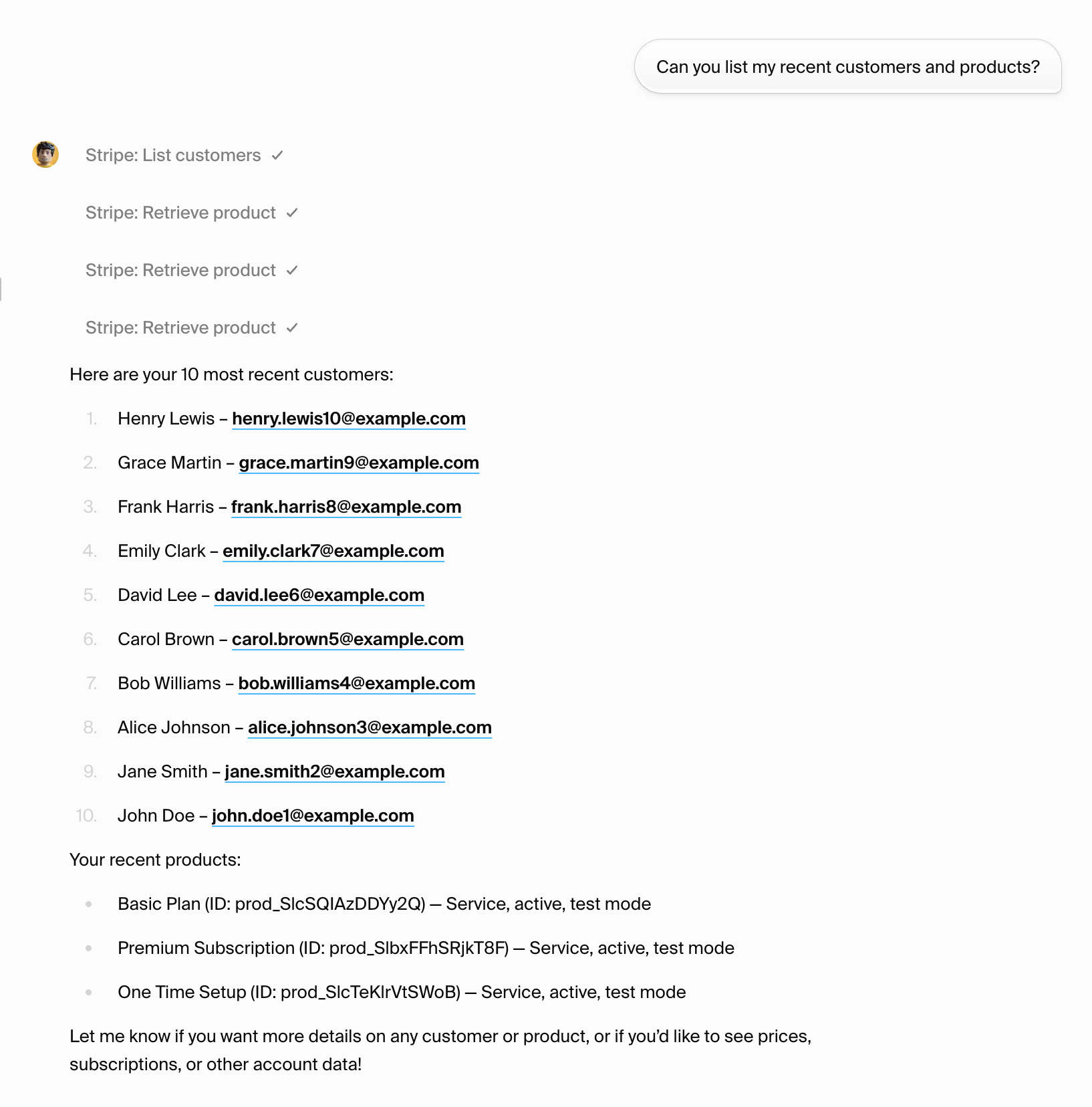

Test permissions

Verify your API key has the necessary permissions:

Setting up your Stripe environment

Unlike databases, Stripe doesn’t require schema setup. However, you’ll want to

configure products, pricing, and webhook endpoints for a complete integration.

Create test products

Set up some test products to work with:Update agent instructions

Enhance your agent’s understanding by updating its instructions with your business context:Testing payment operations

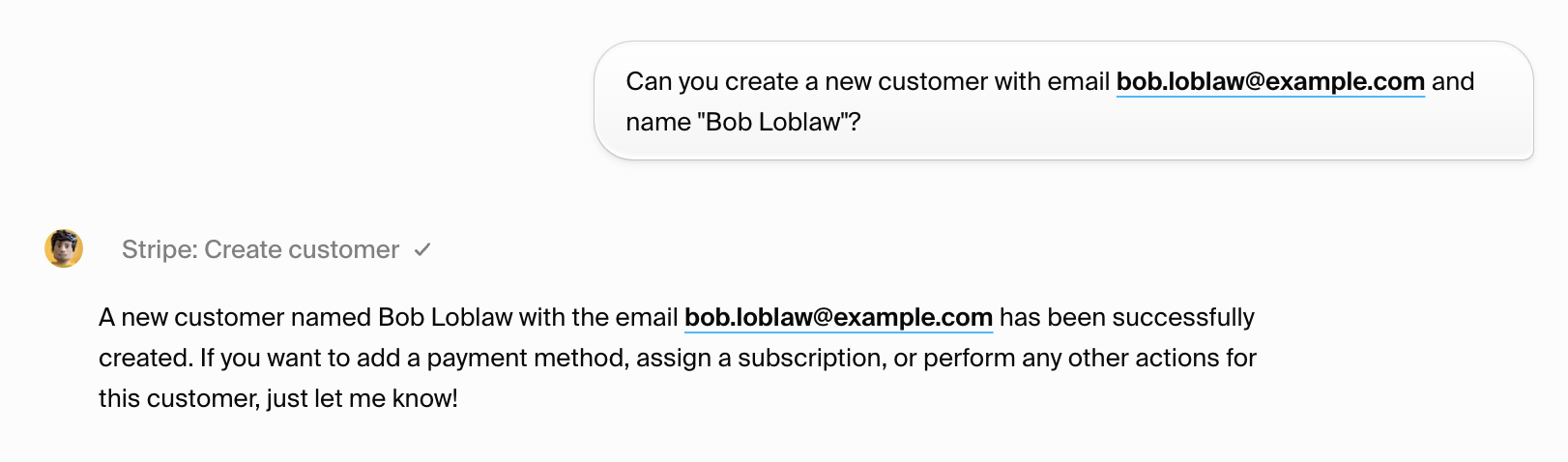

Test 1: Create a customer

Test customer creation capability:

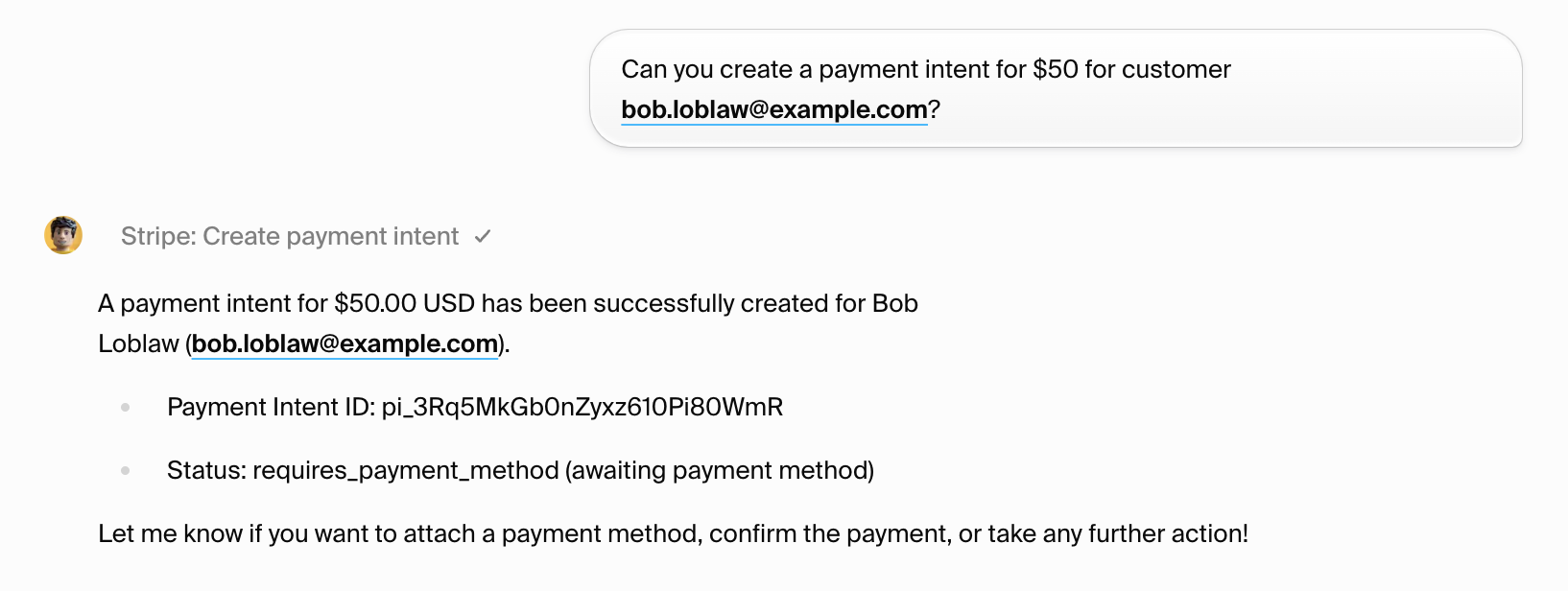

Test 2: Process a test payment

Try processing a payment using Stripe’s test card numbers:In test mode, use Stripe’s test card numbers like

4242424242424242 for

successful payments or 4000000000000002 for declined cards.

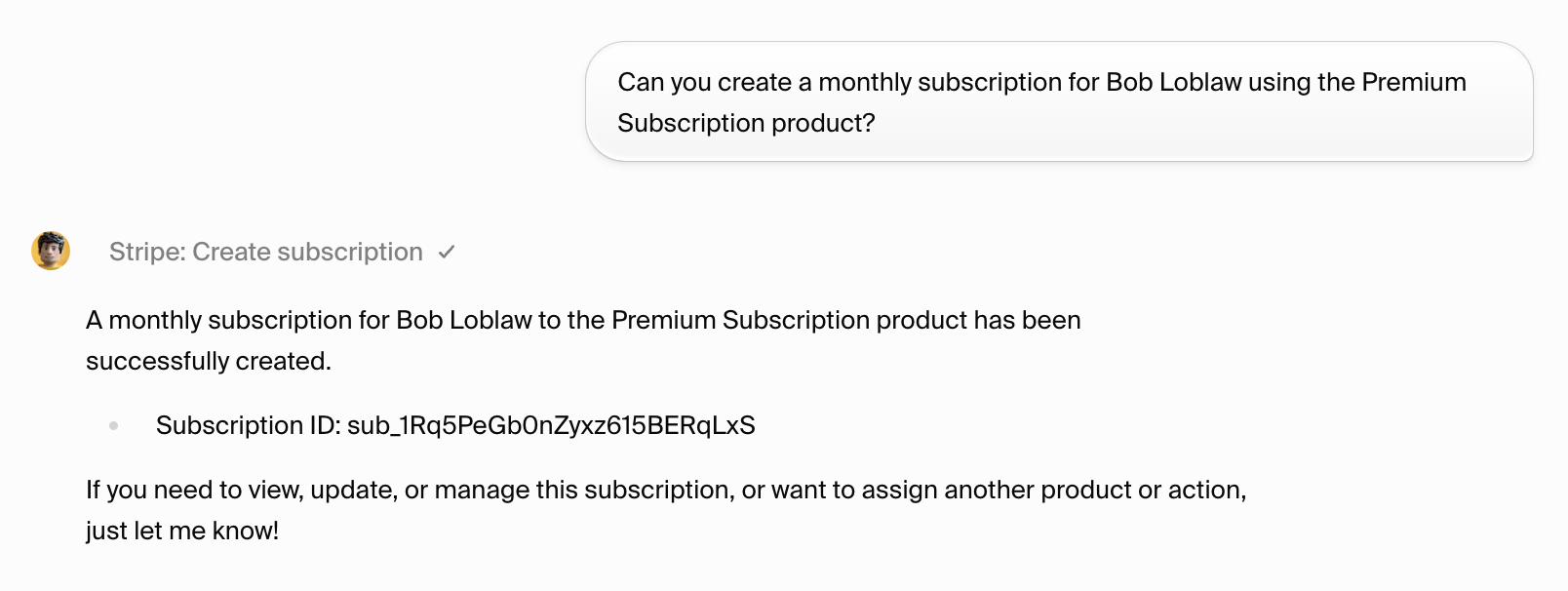

Test 3: Handle subscriptions

Test subscription management:

What you can do

With your Stripe connection established, your agent can:- Process payments with various payment methods

- Manage customers and their payment information

- Handle subscriptions including creation, updates, and cancellations

- Process refunds and handle disputes

- Generate invoices and manage billing

- Analyze financial data and generate reports

- Manage products and pricing dynamically

- Integrate with other tools like CRM systems, email marketing, and accounting software

Best practices

- Security first: Always use restricted API keys with minimal required permissions

- Test thoroughly: Use Stripe’s test environment before going live

- Error handling: Implement robust error handling for payment failures

- Compliance: Ensure PCI compliance and follow data protection regulations

- Monitoring: Set up alerts for failed payments and unusual activity

Advanced operations

Payment processing workflows

Your agent can handle complex payment scenarios:Subscription management

Automate subscription lifecycle management:Financial reporting

Generate comprehensive financial reports:Dispute handling

Manage chargebacks and disputes:Integration examples

E-commerce automation

SaaS billing management

Troubleshooting

Common connection issues

- Invalid API key: Verify your key is correct and has proper permissions

- Test vs Live mode: Ensure your API key matches the intended environment

- Rate limiting: Stripe has rate limits; your agent will handle these automatically

- Insufficient permissions: Update your restricted key permissions as needed

Payment failures

- Declined cards: Use appropriate test card numbers in test mode

- Authentication required: Handle 3D Secure authentication flows

- Insufficient funds: Test with appropriate test card numbers

- Invalid parameters: Verify all required fields are provided correctly

Webhook issues

- Endpoint verification: Ensure your webhook endpoint is accessible

- Event handling: Verify you’re listening for the correct event types

- Signature verification: Implement proper webhook signature verification

Security considerations

Never expose your Stripe secret keys in client-side code, logs, or public

repositories. Always use environment variables or secure key management

systems.

- API key rotation: Regularly rotate your API keys

- Webhook signatures: Always verify webhook signatures to ensure authenticity

- PCI compliance: Follow PCI requirements when handling card data

- Audit logs: Monitor your Stripe dashboard for unusual activity

- Two-factor authentication: Enable 2FA on your Stripe account

Learn more

Combine Stripe with other Hypermode connections to create powerful business

workflows. For example, use Slack to notify your team of large payments,

GitHub to track payment-related code changes, or your CRM to update customer

information after successful payments.

Compliance and regulations

PCI compliance

When handling payment card data:- Use Stripe’s secure payment forms

- Never store card details directly

- Implement proper access controls

- Regularly monitor for vulnerabilities

Data protection

- Follow GDPR requirements for customer data

- Implement proper data retention policies

- Provide mechanisms for data deletion

- Ensure proper consent management

Financial regulations

- Comply with local financial regulations

- Implement proper record keeping

- Ensure accurate tax reporting

- Handle dispute resolution appropriately